International Capital and the Imperial Periphery

- Peace, Land, & Bread

- May 30, 2021

- 14 min read

Updated: Sep 23, 2021

By Thomas McLamb

A Marxist Case Study of the Tendency of the Rate of Profit to Fall and its Conditions in Lebanon 1997-2018

Introduction

Marx’s Law of the Tendency of the Rate of Profit to Fall provides a theoretical foundation for calculating the economics of the social condition of the proletarian-capitalist relationship under capitalism. This study examines the tendency of the rate of profit in Lebanon, 1997-2018, for the purposes of identifying the place of Lebanese profitability within the schema of international capital, specifically that of the dominant Western capitalist economies. The author finds that the existing data on the Lebanese economy challenge the existing Western-centric thought on the tendency of the rate of profit to fall. Additionally, the author finds that the restorations and declinations of the Lebanese rate of profit appear as mirrored inversions of the world rate of profit.

This article argues that an examination of the rate of profit in Lebanon can provide a more thorough empirical understanding of the role of Lebanon in the schema of international capitalism. In its examination, this article utilizes a slew of orthodox and contemporary Marxist economic methods to study the rates of exploitation, rates of profit, and tendencies of imaginary spheres of capital to serve Western imperial capital prior to capital in the imperial periphery. The tendency of the rate of profit in Lebanon is examined in relation to the tendencies of imperial capital for the purposes of illuminating the oft-ignored mechanisms that surround the Lebanese crises of capital. The primary sources consulted and utilized for this article have been gathered and appropriated from the World Bank economic databases. These data are appropriated and serve as functional variables in a series of Marxist formulae from Marx’s Capital Vols. I-III.

V.I. Lenin’s general thesis on imperialism and the export of capital from the dominant capitalist economies is that capitalist economies, within their home borders and in search for greater degrees of profit, must rectify their unsustainable national projects with the expansion of their spheres of capital into the underdeveloped world.

The tendency of the rate of profit (ROP) to fall is the fundamental observation to any significant application of Marx’s theoretical works onto the crises of capitalism. Marx’s work on this tendency posits that the profit mechanisms that sustain the expansion of capital itself are not infinite; or, capital cannot enjoy endless growth. Where the rate of profit is in decline, investment in imaginary capital increases alongside the rate of exploitation in the imperial periphery. Through the cycles of expansion and contraction of profitability, the general rate of profit over time can be observed to be in steady decline in the imperial core. The rate of profit is often temporarily restored or stagnated in the West through social-democratic reforms, i.e., the welfare state, or through the neoliberal programme of allowing the economy to ‘bottom-out.’ Underneath these Western restorations of the rate of profit are the processes by which capital externalizes its crises onto the peripheral developing economies of the world. Despite the temporary imperial restorations of the ROP, it remains in decline with its restorations lasting only a few years at most before dropping lower than previously. This article examines the process of imperial restoration by externalizing crises onto the periphery in a case study on the Lebanese ROP from 1997-2018 as a means of confirming the thesis that the imperial ROP enjoys temporary restorations through externalizing crises onto the periphery; in the case of this analysis, Lebanon.

This article will serve as an empirical Marxist analysis of the rate of profit in Lebanon. This case study will examine the international capitalist economic conditions that saturate the movements of profitability as well as the existing tendencies of Lebanese profitability within the greater context of international capital. The primary documents of reference in support of these theses on Lebanese profitability are almost exclusively data series adapted and reframed from the World Bank data collections on Lebanon from 1997-2018. The primary method of presentation utilizes the interpretations of calculating rate of profit from Michael Roberts’ means of measuring surplus value from large-scale national data series.

This article utilizes in its analysis the concrete form of measure in Marx’s Volume III of Capital whereby money is the unit of measure rather than the previous form of measure via. labor-time in Volume I. The existing literature on the appropriation and rectification of these two forms is best described in J.S. Szumski’s The Transformation Problem Solved where Szumski asserts that the Labor Theory of Value proper in Volume I is best understood as an abstract form of the empirical money-measured form of Volume III. Szumski concludes that while the LTV serves as an explanation for the nature of profits, the formulae relating to the rate of profit in Volume III serve as empirical tools for understanding the processes of commodity production in capitalist economic form.[1]

The literature on the falling rate of profit is immense with little consensus to be had even amongst so-called Marxist economists, but of most note for the purposes of this article are the works from British economist Michael Roberts as well as the works on crisis by Wolfgang Streeck. Roberts’ work serves as the proof-of-concept work for measuring rate of profit utilizing principally bourgeois data series. The Long Depression by Roberts demonstrates the mechanisms and symptoms of the declining rate of profit within the imperial sphere of capital as well as the means by which it restores itself temporarily.[2] Streeck’s arguments in Buying Time are much more compatible with the general theses of this article. Streeck’s work on the occasional recent crises of capital posits that capitalism not only has a limit on the amount of profit it can extract before it resorts to the gambling of imaginary capital, but that capitalism finds a limit in the ways that it can extract profit in a democratic society.[3] Streeck’s work is utilized in the following research as a means of examining the ways in which democratic capitalist societies within the imperial core externalize their internal contradictions of democracy and profit by exporting misery to the periphery through mass external debt stocks. This paper finds its place in the scholarship as a specific case study on the role of Lebanon in the crises of international capital during the Long Depression as well as a confirming thesis on the tendency of imperial capital to project its crises onto the imperial periphery.

One need not observe for long to see that where the imperialist rate of profit is in decline, the rate of profit inclines in Lebanon. Where the Lebanese rate of profit is in decline, the rate of profit experiences incline in the imperialist economies, though to less significant and far more temporary degrees.

The Rate of Profit in Lebanon

From 1997-2002, Lebanon enjoyed a steady increase in profitability with little to no stagnation or decline (See Figure 1). The rate of profit from 1997-2018 presents a different process, showing the typical stages of expansion and contraction identified in Ernest Mandel’s Late Capitalism in his work on the long and short-waves of capitalism.[4] Wages in Lebanon fluctuated year-to-year while fixed capital ownership in this period experienced multi-year contraction leading into revitalized increases in ownership over the means of production from 2000-2008. Somewhat expectedly, and despite the cycles of expansion and contraction in both wages and capital goods’ ownership, nominal GDP increased at steady rates with little-to-no contraction.[5] The rate of profit in Lebanon has gone through a general stage of decline from 2002-2018 but a general incline from 1997-2018. The cycles of Western capital and their consequences in the periphery develop a ripple effect of long-term development of externalizations of crisis.

Figure 1

Source: Author’s Calculations via. World Bank, Lebanon Data Series. Rate of Profit Calculated utilizing Marx’s orthodox formula and Roberts’ interpretation, S/C+V. [6]

Figure 1 displays a far different tendency in the ROP than the world rate of profit calculated by British economist Michael Roberts. Roberts’ work is certainly the most orthodox of contemporary Marxist economic analyses, though unlike other contemporary Marxists, Roberts attempts to understand the functional crises of capital as an international phenomenon. While Roberts’ work on calculating a world rate of profit is well deserving of praise for its significance in analyzing the profitability and exploitative processes of imperial capital, Roberts does not, nor do any of the prominent Marxists of the 21st century, attempt to measure rate of profit in the imperial peripheries. Roberts’ work is derived from calculating a world rate of profit comprised of only the G7 and G20 spheres of imperial capital. In the case of the imperialist accumulation of capital, Western capital externalizes its internal crises onto the imperial periphery. In the case of the United States, this process has presented itself in the form of the endless wars, economic sanctions, proxy wars, and state-funded terrorisms in the Middle East and elsewhere. The subject to observe then in this case study is the relationship of the rate of profit in Lebanon with the international rates of profit.

V.I. Lenin’s general thesis on imperialism and the export of capital from the dominant capitalist economies is that capitalist economies, within their home borders and in search for greater degrees of profit, must rectify their unsustainable national projects with the expansion of their spheres of capital into the underdeveloped world.[7] One-hundred years after Lenin’s works the spheres of capital in the Western imperialist world have more-or-less subsumed each other into one dominant sphere of capital comprising all of the G7, arguably the G20, economies. These economies have woven a web of interconnectedness by which the economic processes of one affect the processes of the other. Just as these economies affect one another, they too subjugate the economies of the developing spheres of capital, certainly including the economic processes of Lebanon.

From 1997 to present the G7 economies have experienced a declining rate of profit that proceeds immediately from the neoliberal austerity programme of ‘83 - ’86. Where the rate of profit is then in decline in these imperialist core economies, the rate of profit has a general pattern of incline in the periphery, again in this case, Lebanon. Until roughly 2002, during the period of the Long Depression, empire’s ROP remained in a general tendency of decline.[8] It is this moment when one can observe the temporary restoration of the ROP from 2002-2004, coinciding with the end to Lebanon’s steady incline in the ROP. As expected, the restoration of the imperialist ROP lasted only a few years before sinking to a rate at nearly the same level of the profitability crises four decades prior during the international crash of ’08 (See both Fig. 1 and Fig. 2).

Figure 2

Source: Michael Roberts’ calculations of a World Rate of Profit. Alternatively, data are available in Michael Roberts, “The Long Depression: How it Happened, Why it Happened, and What Happens Next.” (Chicago: Haymarket Books, 2016).[9]

One need not observe for long to see that where the imperialist rate of profit is in decline, the rate of profit inclines in Lebanon (See Figures 1 and 2). Where the Lebanese rate of profit is in decline, the rate of profit experiences incline in the imperialist economies, though to less significant and far more temporary degrees. Because these imperialist economies are far more developed than that of the periphery and their spheres of capital are far more accumulated towards-monopoly, the fluctuations in the rate of profit are far more exaggerated with restorations occurring over shorter periods of time than in the peripheral developments.

The period of decline of the ROP in Lebanon remained after the imperial restoration largely due to the Israeli invasion, occupation, and bombarding of Lebanon in 2006 and subsequent universal recession of 2008. While Ernest Mandel’s discoveries on war economies in Late Capitalism present a thesis that mass production during these eras oft encourage short-term restorations in profitability for the imperialist country, the reality of this imperial restoration is that the hinders of profitability are merely externalized and projected onto the imperial subject.[10] Crisis cannot be simply erased within the imperial core, rather it is pushed outwards onto developing economies. Take the Israeli invasion of Lebanon; Profitability is generated in either function or attempt in the Israeli imperial core during the occupation while profitability experienced immediate contraction and subsequent long-term slow growth in Lebanon, the imperial periphery.

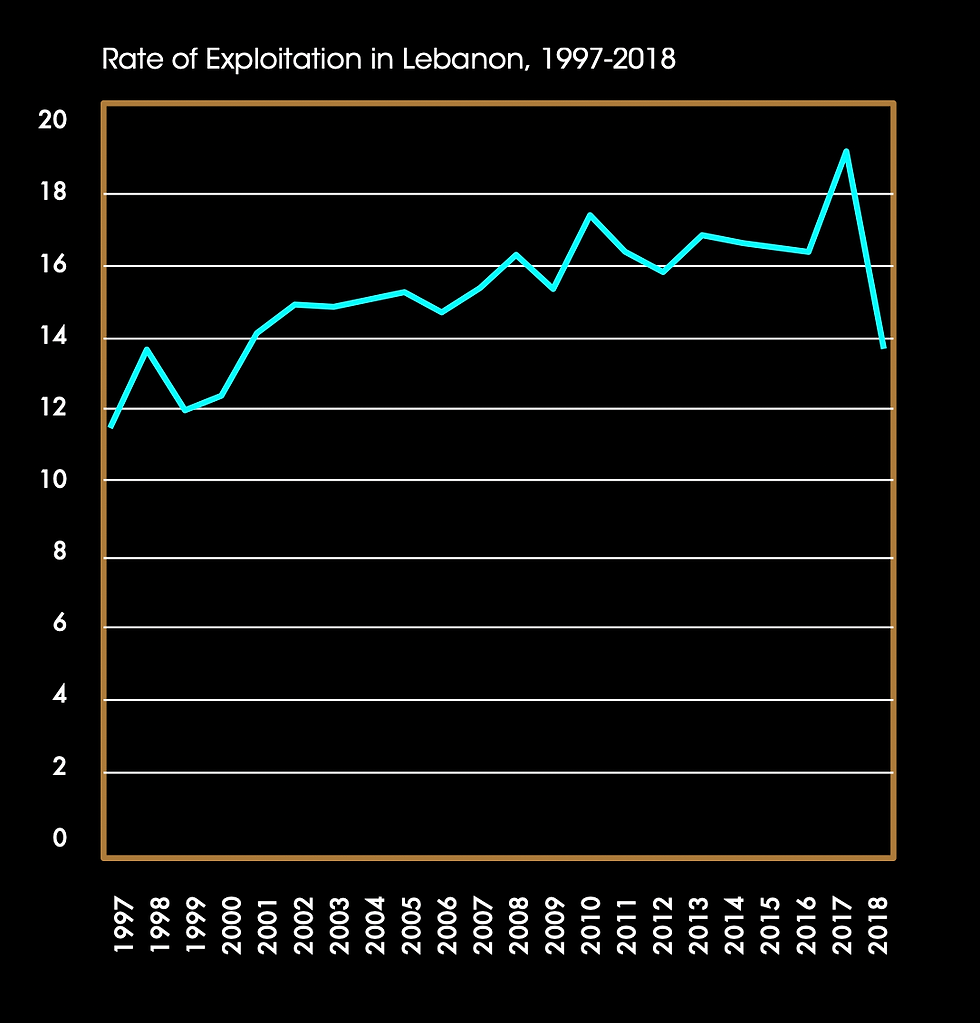

In addition to the obvious circumstances of the impacts of imperialist occupation and military bombarding of Lebanon, trade indicators 1997-2018 illuminate the involvement of outside spheres of capital on the general exploitation of Lebanese production. Trade in Lebanon has only exceeded the GDP twice between 1997 and 2018; first in 2008 at 106.63% of GDP, second in 2011 at 102.14% (See Figure 3). Where the rate of profit experiences steady inclines from 1997-2002, a declining rate of profit correlates directly with rapid increases in foreign trade, nearly double from ’03-’04. This process suggests that the declining rate of profit is certainly tied to contradictions of production rather than consumption as many bourgeois economists suggest today. Regardless, profitability suffers within the Lebanese sphere of Lebanon while it serves to restore imperial capital. Where foreign trade increases, there is a direct and proportionate pattern of higher rates of exploitation of Lebanese proletarians (See Figure 4).

Figure 3.

Source: World Bank national accounts data, and OECD National Accounts data files.[11]

Figure 4

Source: Author’s Calculations via. World Bank, Lebanon Data Series. Rate of Exploitation calculated using S/V.[12]

Just as trade in Lebanon with foreign spheres of capital follows an inverted form of the cycles of declination and inclination of the Lebanese rate of profit, it follows the restorations of imperial capital of its own tendencies. Exploitation is thus in a general upwards trend where trade increases in Lebanon displaying confirmation of the thesis that restorations in the rate of profit in the Western world are not simply the product of insular economic policy in the imperial core but rather the product of externalizing crises onto the periphery. Crises are externalized onto Lebanon for the purpose of serving imperial restoration.

The data series on the rate of exploitation in Lebanon show two things. First, the confirmation of a near identical percent increase over the 21-year period of exploitation and increases in trade. Second, the series shows the tendency of exploitation to increase where restorations in the imperial rate of profit occur. There is the elephant in the room that is the 2008 economic crisis that resulted in a near universal decline in the rate of profit in the core and peripheries of empire. Despite this fluctuation, the tendency of trade to increase in Lebanon as capital is accumulated in the imperial core alongside the rate of profit to follow a mirrored path of the rate of profit in the imperial core allows one to see the process that crises are externalized onto the periphery by the core during the long-term decline and crises of imperial capital.

Trade and exploitation are only functional aspects of the greater processes of externalizing crises from the imperial core onto the periphery. The crises of late capitalism in the Western imperial core largely result in the form of imaginary capital. Imaginary capital is most succinctly descried as the moneyed processes of capitalism built solely from speculation or gambling. These imaginary spheres of capital are most often observed as stocks, bonds, shares, or debt stocks.[13] The observations and analyses presented thus far have established the mirrored relationship that Lebanese capital experiences under the subjugation of imperial capital. The means by which this happens is less clear, though observing the processes of external debt accumulation in the periphery can illuminate far more.

The declining rate of profit makes necessary the speculative gambling of finance capital whereby they substitute profit-extraction from commodity production for profit-extraction through accumulation of imaginary capital. Lebanon is not exempt as a subject to this speculative gambling of imperial capital. While the rate of profit has not been in decline in Lebanon from 1997-2018, it has certainly experienced inclines in trade, exploitation, and investment from foreign capital gamblers during periods of imperial decline (See all previous figures). As shortly as possible, where empire is in decline, debt, or engagement in imaginary capital, is on the rise in Lebanon. The consequences of the declining ROP within the spheres of empire take the form of imaginary moneyed investments into Lebanon resulting in higher degrees of exploitation with each passing year. These moneyed investments are attempts, and often successes even if temporary, to restore the rate of profit by artificially increasing the rates of exploitation and consequently profit in the imperial periphery. For Lebanon, these speculative gambles by the imperialist are exhibited in the data series examining external debt in Fig. 5. This external debt places the imperial periphery in a capitalist sphere of rent-owing economy indefinitely to the imperial core when the external debt (money owed through imperial gambling) surpasses the GDP.

Figure 5

Source: Author’s Calculations via World Bank, Lebanon Data Series. Calculated using Ext. Debt/GDP.[14]

Figure 5 displays the historic increases in the levels of external debt to GDP in Lebanon. As shown, in 2004 the percent of external debt to GDP exceeds 100%. These levels of external debt are indicative of the general health of the imperial spheres of capital though they secondarily indicate the general tendency of profitability in Lebanon.

Profitability will increase in the imperial core until it can no longer extract value through simple commodity production within the national borders. This failure to extract profit further signals the decline in national profitability and the initial stage of capitalist crisis. The crises faced by Lebanon at present then are two-fold. First, Lebanon is subject to the endless externalization of crisis onto its economy by the insufferable gambling of imperialist capital. Second, Lebanon is subject to its own development of crises through mass accumulation of debt and the exploitation of its own commodity and value production by empire. Empire’s enjoyment of the fruit of imaginary capital has merely been through the partial replacement of its own exploitation via commodity production with the exploitation of peripheral spheres of capital, all of which have been party to the continuous process of the accumulation of capital towards-monopoly of the few richest capitalists in the world.

Concluding Remarks

The rate of profit in Lebanon indicates a mirrored relationship with the international rate of profit calculated in Roberts’ work from 1997-2018. This mirrored relationship illuminates the patterns by which the imperialist countries of the world externalize their crises onto the Lebanese economy. Imperial capital cannot endlessly extract profit from its own core, it must engage in international expansion of its processes of production. Lenin’s observations in Imperialism allow us to understand the theoretical means by which this happens, though Marx’s work in Capital Vol. III allow us the tools to calculate these processes ourselves. The rate of profit is certainly not in decline in Lebanon, though where it experiences decline, profitability is temporarily restored within the imperial core. There is at present a rapidly increasing level of wealth inequality alongside an ever-increasing rate of exploitation within Lebanon’s sphere of capital, though these developments are not isolated, they are subject to the movements and unsustainable nature of international capital. It is my hope that these data presented, and the analysis provided, serve in some way as a reference point for the work contributed in the future on the condition of capital in the periphery.

Endnotes

[1] J.S. Szumski, “The Transformation Crisis Solved?” in Cambridge Journal of Economics, Vol. 13 No. 3. (Oxford: Oxford University Press, 1989), Pg. 431-452.

[2] Michael Roberts, “The Long Depression: How it Happened, why it Happened, and What Happens Next,” (Chicago: Haymarket Books, 2016).

[3] Wolfgang Streeck, “Buying Time: The Delayed Crises of Democratic Capitalism, 2nd Edition.” New York: Verso Books, 2017.

[4] Ernest Mandel, “Late Capitalism, 2nd Edition.” New York: Verso Books, 1999. And Ernest Mandel, “Long Waves of Capitalist Development.” New York: Verso Books, 1995.

[5] World Bank National Accounts data, OECD National Accounts data files, and International Monetary Fund Government Statistics Yearbook and data files. All listed data series aggregated an accessed via. World Bank data visualization tools through data.worldbank.org.

[6] Rate of Profit in Lebanon, 1997-2018. Calculated by Author. Calculated using World Bank National Accounts data, OECD National Accounts data files, International Monetary Fund Government Finance Statistics Yearbook. All listed data series aggregated and accessed via. World Bank data visualization tools through data.worldbank.org. Also of note, see Michael Roberts’ formulations of the world rate of profit for clarification on application of formulae.

[7] V.I. Lenin, “Imperialism: The Highest Stage of Capitalism.”

[8] Michael Roberts, “The Long Depression.”

[9] https://thenextrecession.wordpress.com/2020/07/25/a-world-rate-of-profit-a-new-approach/ Michael Roberts, “A World Rate of Profit: A New Approach.” Accessed via.

[10] Ernest Mandel, “Late Capitalism.”

[11] World Bank National Accounts data and OECD National Accounts data files. See [6].

[12] Formula used to calculate rate of exploitation is again an orthodox Marxist formula, S/V. Where S = Surplus value and V = Variable Capital. See previous notes for clarification on calculating surplus value in the S/C+V formula. Data series utilized via. World Bank National Accounts, OECD National Accounts data files, International Monetary Fund, Government Finance Statistics Yearbook. See [6]. Formula used appropriated via. both Marx’s Capital and Michael Roberts interpretation thereof. See also; Michael Roberts, “Marx 200: A Review of Marx’s Economics.” (Lulu.com: 2018). See also; Michael Roberts, “A World Rate of Profit: A New Approach.”

[13] Michael Roberts, “The Long Depression,” Ch. 6.

[14] World Bank, International Debt Statistics; and World Bank National Accounts data and OECD National Accounts data files. See [6].

Bibliography

Lenin, V.I. Imperialism: The Highest Stage of Capitalism. Penguin, 2010.

Roberts, Michael. The Long Depression: How it Happened, why it Happened, and What Happens Next. Haymarket Books, 2016.

https://thenextrecession.wordpress.com/2020/07/25/a-world-rate-of-profit-a-new-approach/Roberts, Michael. A World Rate of Profit: A New Approach. Self-Published. Accessed via.

Streeck, Wolfgang. Buying Time: The Delayed Crises of Democratic Capitalism, 2nd Edition. Verso Books, 2017.

Szumski, J.S. “The Transformation Problem Solved?” Cambridge Journal of Economics. Vol. 13, No. 3. Pp. 431-452.

World Bank data visualization tools. Accessed via. data.worldbank.org.

Comments